Washington, D.C. – On January 20, 2025, President Donald Trump revealed a bold plan to impose a 25% tariff on all goods imported from Canada and Mexico starting February 1. The announcement, described as part of his broader strategy to address trade imbalances and enhance border security, has already begun to shake markets, as reported by CNN.

The proposed tariffs immediately impacted financial markets, with the Mexican peso and Canadian dollar declining in value. Analysts cited investor concerns about the economic consequences of strained trade relations. According to Yahoo Finance, major U.S. stock indices also fluctuated as traders weighed the potential fallout across industries dependent on cross-border trade.

Canadian officials responded swiftly, with Foreign Minister Mélanie Joly stating that the government is prepared to take countermeasures if necessary. Finance Minister Dominic LeBlanc emphasized the critical economic ties between Canada and the U.S., where cross-border trade amounts to $2.7 billion USD daily. The potential tariffs could severely impact Canada, which sends 75% of its exports to the U.S., according to AP News.

The Mexican government also expressed concern about the tariffs, which could disproportionately affect industries such as automotive manufacturing and agriculture. Bloomberg highlighted Mexico’s vulnerability due to its deep trade ties with the U.S. and reliance on export-driven industries.

While President Trump did not announce new tariffs on Chinese imports, he hinted that future actions could target countries perceived to have unfair trade practices, including alleged intellectual property theft. This cautious approach towards China has left global investors on edge, as reported by The Australian.

Economists warn that these tariffs may lead to higher prices for American consumers and significant disruptions to supply chains. Businesses that depend on cross-border trade with Canada and Mexico are urged to prepare for the potential financial impact. As noted by Business Insider, industries such as automotive manufacturing, retail, and agriculture could face significant challenges if the tariffs are implemented.

As markets react to the announcement, CNBC reported that futures trading exhibited both gains and volatility, signaling uncertainty about how these policies will unfold. Experts believe that the full effects of these tariffs will depend on negotiations and possible retaliatory actions from Canada and Mexico.

This significant shift in U.S. trade policy underscores President Trump’s renewed focus on protecting American economic interests during his second term. As businesses and global markets brace for potential fallout, the coming weeks will be critical in determining the broader implications of these tariffs on international trade.

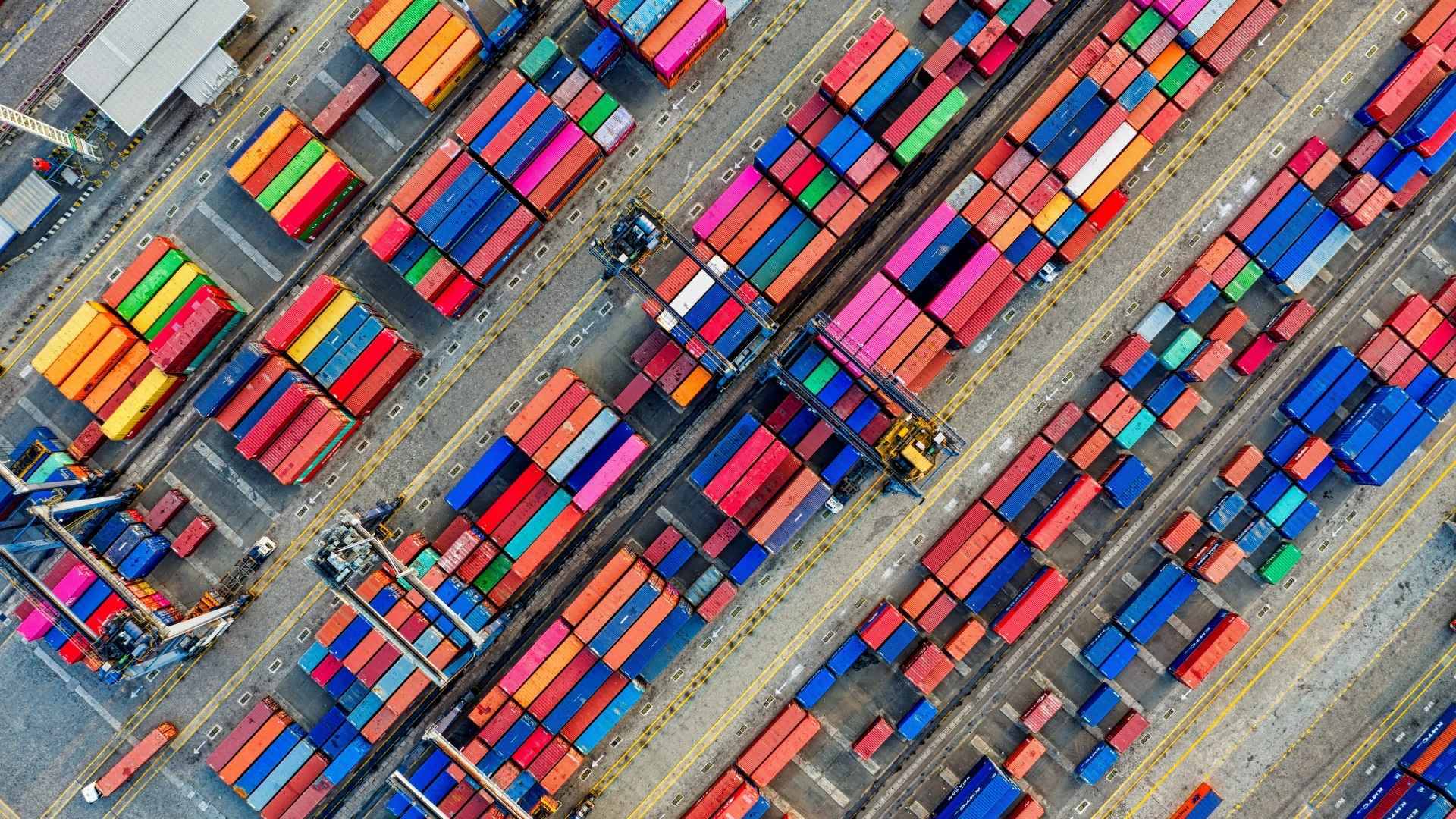

Meta Description: Feature Image: A depiction of shipping containers with U.S., Canadian, and Mexican flags, symbolizing the impact of trade tariffs.

Image File Name: us-canada-mexico-trade-tariffs.jpg

Alt Text: Shipping containers adorned with U.S., Canadian, and Mexican flags representing trade and tariffs.